CNBC running “pump and dump” Bitcoin scam to fleece viewers, warns Peter Schiff

08/08/2018 / By JD Heyes

The economic prophet who correctly predicted the 2008 housing collapse and ensuing “Great Recession” has said during a recent podcast that financial news network CNBC continues to promote the viability of Bitcoin despite the fact that the cryptocurrency is headed for collapse.

Appearing on the Quoth the Raven podcast, Peter Schiff said the network hasn’t had him back as a guest in about a year following a “bitcoin versus gold debate” he had with another guest, Brian Kelly of BK Capital Management, in which he disparaged the cryptocurrency.

Schiff said that the network pledged to have him back but that it hasn’t happened. Meanwhile, Kelly, who took the side of bitcoin, is a frequent guest.

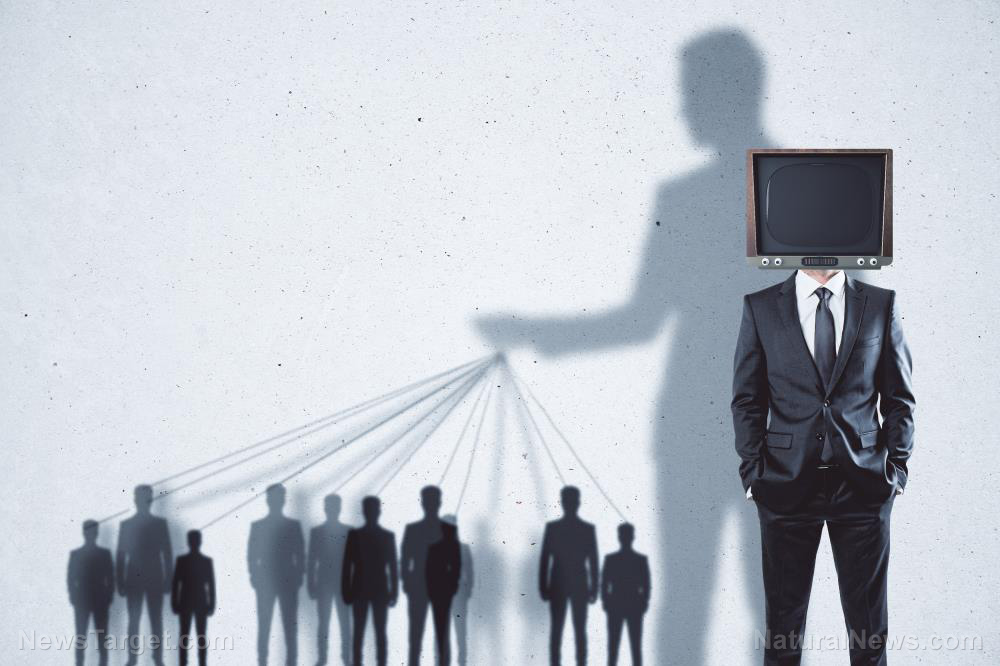

The prophetic financial advisor accused CNBC of running an “organized pump and dump” scam by pushing bitcoin hard while ignoring warning signs that cryptocurrencies are not just risky but potentially financially destabilizing as well.

“I think they know I’m negative on bitcoin and they don’t want any negative perspectives,” he said on the podcast. “They’re there to constantly try to convince their viewers to buy these coins so that the people that come on the show can get out of theirs. They’re trying to create demand.”

He noted that in the current economy, bitcoin “is deflating,” and “if you want to get out, somebody has to come in and provide the buying. And so that’s what they’re (CNBC) doing.”

Schiff opined that the network no longer wanted to book him “not because I’m bearish on the economy but because I’m bearish on bitcoin.”

“I mean, they can’t even spot that bubble? That’s how bad CNBC is at spotting bubbles,” he noted, adding that the network “did not cover bitcoin at all” when it was far cheaper to buy.

Bitcoin hypocrisy at CNBC

The QTR host noted that Kelly, who has been at the network for years, never mentioned bitcoin when the price was low. But then one day when he was hyping bitcoin after its alleged value increased dramatically, he said Kelly was “going down a checklist of ways you can buy bitcoin, and conveniently…third on the list” was his own firm.

“So, this guy, who has never mentioned [bitcoin] before, is now presenting it to viewers, like, ‘not only go out and buy it but buy it through me, like, I have my own crypto asset management company,’” the QTR host said. (Related: Young cryptocurrency morons think they will own the world without effort… welcome to Millennial delusions gone digital.)

Schiff, who served as an economic advisor to then-Rep. Ron Paul, R-Texas, who ran for president in 2008 as GOP candidate, also discussed how Keynesian and Austrian economic theories differ, as well as the politics surrounding POTUS Donald Trump’s economics, the recent volatility in tech stocks and how inflation affects the middle class, as well as other subjects.

But he also addressed how wrong the regular and financial media, as well as ‘mainstream’ economists, were in 2008, an accusation he’s also had to deal with recently because of his bearish outlook.

“It’s a total double standard because it shows you their way of thinking,” he said. “If you look at all of these experts that were completely wrong now that we’re 10 years from the financial crisis…by 2007, the bubble had burst…even after it was so completely obvious. I was predicting it. They didn’t figure it out until everything had imploded.”

He also recalled how, during television appearances in 2008, he would say the country was in a recession, but he got pushback from other economists who had concluded there was “no recession in sight.”

As for bitcoin, Schiff criticized Kelly for hyping bitcoin at $20,000 and $30,000 to viewers but then announcing that he himself had sold his holdings during a rally.

“And now after the fact you’re disclosing that you sold into that rally?” Schiff said, noting the hypocrisy.

Read more about bitcoin’s coming demise at BitcoinCrash.news.

Sources include:

Tagged Under: bearish, bias, bitcoin, Brian Kelly, Bubble, CNBC, Collapse, cryptocurrencies, devalue, economic policy, economics, finance, financial news, Peter Schiff, propaganda, U.S. dollar, worthless